The EU Pharmaceutical Package is a series of legislative proposals that aims to, among other things, improve access, affordability, and availability of medicinal products across EU Member States, while intending to foster innovation and ensure a future-proof, crisis-resistant regulatory ecosystem.

The last comprehensive review of the EU pharmaceutical legislation was tabled almost 20 years ago. Published on April 26, 2023, the Pharmaceutical Package includes not only the pharmaceutical legislation but also orphan drugs and pediatric medicines legislation. Last but not least, the package includes a Council Recommendation to step up the fight against antimicrobial resistance (AMR).

The EU is the second-largest market in the world for pharmaceuticals. Understanding the implications is crucial for successful market entry, including for companies based in the United States.

EUCOPE, the EU trade body representing smaller biopharma companies, provides an assessment of the ongoing revision of the EU pharmaceutical legislation and its potential impact on U.S. biopharmaceutical companies looking to invest and launch in the EU, highlighting potential challenges and considerations for smaller companies.

Impact of the EU Pharmaceutical Package on U.S. companies

A critical concern for U.S. pharmaceutical companies considering entry into the EU market is the potential impact on innovation. The EU Pharmaceutical Package seeks to balance patient access to affordable medicines with the need to foster innovation. However, increased regulatory requirements, pricing pressures, and market access challenges may discourage innovative U.S. companies, and smaller companies in particular, from investing in the EU. This could have long-term implications for the availability of novel therapies within the EU.

Below is an overview of some of the main changes proposed in the Package.

Regulatory framework

The Package brings welcomed changes, including long-standing asks from EUCOPE and the industry at large regarding the streamlining, digitalization, and acceleration of marketing authorization procedures, reducing European Medicines Agency (EMA) approval timelines to 180 days.

Moreover, other changes include a renewed EMA structure with a stronger patient voice, a wider scope for the centralized procedure, strengthened scientific advice and regulatory support of EMA for Orphan Medicinal Products (OMPs) and for small and mid-sized companies, the regulatory sandbox, and finally, an openness to Real-World Evidence (RWE), which helps to future-proof the Regulation.

Despite these positive changes, the proposed revision may have significant implications for industry. Adapting to the revised legislation and requirements can be challenging for developers, especially those unfamiliar with the EU regulatory framework.

Product Launch and Market Access

The EU Pharmaceutical Package emphasizes the importance of timely and equitable access to medicinal products. Under the proposed new rules, pharmaceutical companies that launch their products in all 27 Member States within two or three years would receive a longer period of exclusivity—two (+2) years in the case of Regulatory Data Protection (RDP), and one (+1) year in the case of Orphan Marketing Exclusivity (OME).

This can pose challenges for smaller companies in terms of navigating complex reimbursement processes, pricing negotiations, supply logistics, and market access requirements. These processes can be time-consuming and resource intensive, and the outcome is uncertain, as it does not depend solely on developer or marketing authorization holders. Smaller U.S. companies with no established networks, infrastructures, or physical presence in Europe—and no market knowledge—will find it virtually impossible to effectively launch their products across all 27 Member States.

Regulatory Data Protection (RDP)

Robust Regulatory Data Protection (RDP) provides pharmaceutical companies with the predictability to invest in expensive and time-consuming research and development (R&D) activities. This applies especially to innovative and advanced therapies since RDP ensures companies can recoup their investments and fosters a competitive environment.

With the current revision, several incentives are being considered to enhance access to medicines and overcome unmet medical needs—including a modulation of RDP, based on conditionalities. Under this system, the fixed period of eight years of RDP has been reduced to six years, followed by two years of market protection. This means an effective baseline of protection of eight years.

By modulating incentives, companies will only receive their maximum duration of regulatory protection, which is 12 years (10 years of RDP, followed by two years of market protection), if they meet a series of conditions:

- +2 years RDP for launching in all EU Member States within a defined timeframe (of two or three years from marketing authorization);

- +6 months RDP for addressing unmet medical needs;

- +6 months RDP for conducting comparative clinical trials; and,

- +1 year RDP for developing a new indication with significant clinical benefit.

Balanced and predictable RDP framework is crucial to incentivize innovators to develop new and innovative medicinal products, as both clinical development and commercialization of treatments are risky, time-intensive, and costly. This process requires predictability in the incentives, which would be missed by attaching RDP to conditionalities. Thus, the proposed modulation of RDP increases unpredictability. This will likely hamper innovation, lower investments, and make the EU less competitive and appealing to launch for U.S. companies, especially smaller ones, which need a stronger and stable incentive framework.

Impact on Orphan Drug Developers

The EU has long been a pioneer in promoting orphan drug development, which focuses on rare diseases affecting small patient populations. The EU Pharmaceutical Package aims to provide incentives and support to foster R&D of orphan drugs across the EU. The super package will revise the overall incentive framework, both in the general pharmaceutical legislation (GPL) and in the Orphan Medicinal Product (OMP) Regulation. This will incentivize the development of medicinal products in therapeutic areas that are currently underserved, especially in areas of unmet medical need.

(High) Unmet Medical Need (HUMN)

One key focus of the EU Pharmaceutical Package is addressing unmet medical needs within the EU market. Frequently, UMN is regarded as relating to a condition for which there exists no satisfactory method of diagnosis, prevention, or treatment. Aware of the fact that different needs exist in the rare disease space, to prioritize the development and availability of innovative medicines for rare diseases where more significant unmet needs exist, including lack of available treatments, the European Commission has proposed the concept of high unmet medical need (HUMN).

While this objective aims to improve development of new therapies for very small patient populations that lack effective treatment options, it may present challenges for smaller companies and overlook other patients that would benefit from novel therapies. For companies to demonstrate that a medicinal product addresses a HUMN, developers must generate supporting evidence at a very early stage of development. By setting criteria and stringent requirements to identify medicinal products addressing HUMN, the European Commission fails to take a holistic perspective. Among other things, unmet needs evolve within the same disease, medical needs change over time, and the onset and progression of chronic diseases make it challenging to define UMN. Hence, defining (H)UMN in the legislation could have unintended consequences for developers and hamper R&D, leading to diminished therapeutic innovation and patient access, and lesser reward for innovative companies.

Orphan Market Exclusivity (OME)

A predictable Orphan Market Exclusivity (OME) framework provides incentives for companies to develop orphan medicines for rare diseases that might otherwise be neglected due to limited profit potential. There is a need for a modulated OME framework to support the development of therapies in areas with no viable treatment options while encouraging innovation in conditions where patients can still derive benefits from new developments.

Under the Commission’s proposal, the OME is modulated as follows:

- 10 years for OMPs addressing HUMN—while all OMPs are considered to address UMN, a separate HUMN definition is introduced;

- 5 years for well-established use OMPs; and,

- 9 years for all remaining OMPs.

Moreover, OMPs that receive nine or 10 years of OME can extend the exclusivity period up to three years, if the following conditions are met:

- Launching in all EU Member States within a predefined timeframe (+1-year OME)

- Expanding in a new orphan indication (+1-year OME, twice)

Although the European Commission’s ambition is to reward products it considers bring the greatest benefit and are made accessible in all EU Member States, by focusing respectively on HUMN and launch conditionality, there could be an impact on biotechs or pharma companies seeking to invest or launch in the EU. By reducing baseline incentives and increasing unpredictability, the proposed modulation of OME will hinder innovation, reduce investments and, therefore, make the EU less competitive and attractive to U.S. companies.

Conclusions: EU Pharmaceutical Package

The EU Pharmaceutical Package brings both opportunities and challenges for U.S. pharmaceutical companies considering expansion into the European Union. While the legislation aims to enhance patient access to medicines and promote public health, smaller companies may face various hurdles. These challenges include addressing (high) unmet medical needs, navigating complex market access processes, and facing a reduction and conditional modulation of incentives, therefore making investments more unpredictable and riskier. Investment is the precondition to drive innovation.

With the proposed arrangements, the European Commission introduces uncertainty and unpredictability in the ecosystem, even more for US developers and small companies that have no presence in the EU yet. Understanding and addressing these potential issues will be crucial for US biopharmaceutical companies seeking to establish a successful presence in the EU.

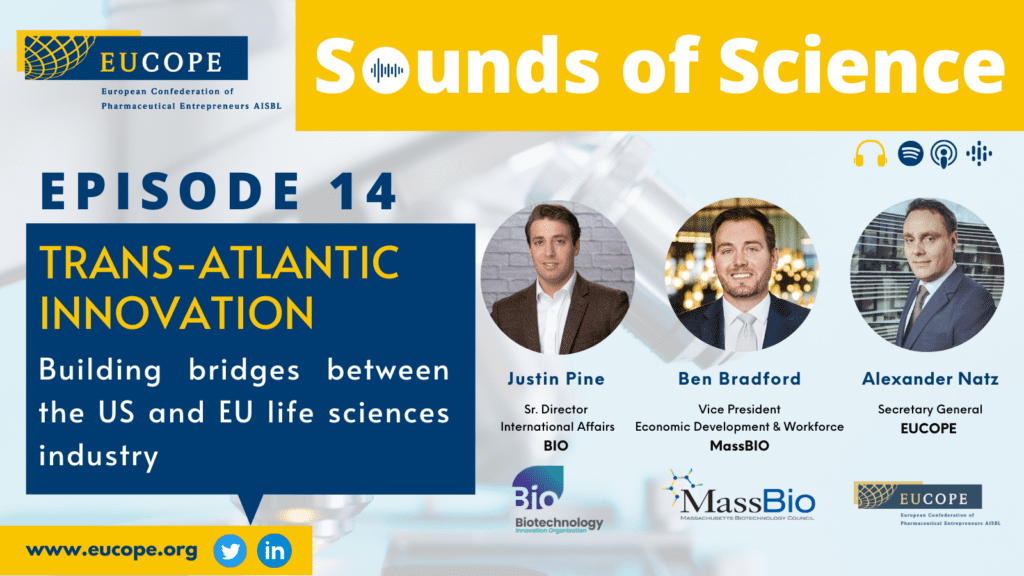

Join EUCOPE at the BIO International Convention to learn more about the new EU Pharmaceutical Landscape!

If you’d like to learn more about the new EU health technology ecosystem, we invite you to join EUCOPE’s panel session, The New European Pharmaceutical Landscape: What you need to know when launching in the EU. The session will take place on Monday, June 5, from 13:00 – 14:00 ET in Room 209.