The House Ways and Means Committee learned how lawmakers can enable progress in biotech from a Biotechnology Innovation Organization (BIO) Board member and the head of BioUtah at a July 12 field hearing in Salt Lake City.

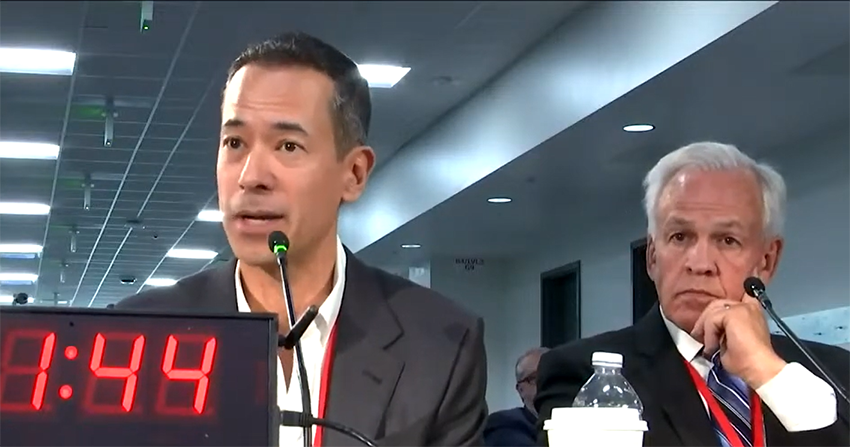

Arcutis Biotherapeutics President and CEO Frank Watanabe, a BIO Board member, and BioUtah President and CEO Kelvyn Cullimore were among witnesses who explained how to provide greater support to biotech.

“The Ways and Means Committee is in Salt Lake City to listen and learn directly from Americans making the next generation of medicines and the patients who are benefiting from those breakthroughs to see what Congress can do to encourage medical innovation in America,” said Committee Chair Jason Smith (R-MO).

Discussion covered legislative proposals to undo troubling provisions of the Inflation Reduction Act (IRA), tax policy to incentivize research and innovation, and other policy support for biotech.

Arcutis Biotherapeutics’ Watanabe explains why biotech matters

“In the last quarter century, American life expectancy has continued its steady increase upwards, with roughly one-third of that improvement directly attributable to biopharmaceutical innovations,” according to his testimony as prepared for the hearing.

As for economic impact, Watanabe said 127,000 biotech companies directly employ 2.14 million in the U.S.

“In total, the biopharmaceutical industry provided $359 billion in wages and benefits to Americans in 2020,” he said. Studies estimate biotech’s direct and indirect contribution to GDP to be 2-7%. “Our sector’s economic impact on the U.S. economy totaled $2.9 trillion dollars in 2021, as measured by overall output.”

Biotech capabilities enhance national security by ensuring we can care for ourselves, Watanabe said.

“But our current leadership in biotech can’t be taken for granted,” he warned. “The robust biotech ecosystem in the United States is at risk both from recent overt policy choices and through long-term neglect of the critical elements necessary for the domestic industry to grow and thrive.”

The challenges posed by the IRA

Watanabe cited a 2021 study showing Inflation Reduction Act (IRA) price controls would lead to 135 fewer drugs being developed through 2039.

He also noted damage caused by the IRA “pill penalty,” under which small molecule drugs—typically pills—receive only nine years of protection from price controls while biologics receive 13 years of protection.

“What the authors of these provisions failed to understand is that half of the cumulative sales of a new medication following [Food and Drug Administration] approval accrue in years 10 through 13,” said Watanabe. “The implication for investors today is clear: direct your funding to biologics, where the potential revenue is significantly higher. This discrepancy fails to capture that small-molecule drug development is similarly risky, just as costly, and is clinically valuable and critical to patients.”

He urged passage of the bipartisan Ensuring Pathways to Innovative Cures (EPIC) Act to give small molecule drugs the same 13-year protection as biologics.

IRA also threatens the development of orphan drugs for rare diseases.

“Orphan drugs initially developed and approved for one condition often prove effective against other rare diseases following additional clinical testing,” said his written testimony. “But the IRA disincentivizes researchers and investors from pursuing such costly follow-on research to find new orphan designations and approvals because, if their efforts prove successful, the drug would no longer be exempt from government price controls.”

He called for the passage of the ORPHAN Cures Act, which would allow orphan drugs to remain exempt from price controls even if approved against more than one indication.

The importance of SMEs

Supporting orphan drug development and biotech in general requires understanding the needs of small- and medium-sized enterprises.

“SME biotech firms account for over 73% of the global clinical pipeline and 85% of all orphan-designated products in development,” he explained. “Approximately one-third of all new drugs approved by the FDA since 2009 were developed by biotech companies with annual revenues of less than $100 million.”

He used his own company as an example of the challenges faced by biotech SMEs. Arcutis has three FDA-approved products: topical medications for treating plaque psoriasis, seborrheic dermatitis, and atopic dermatitis.

“At Arcutis, we feel quite fortunate that it only took six years and nearly $1 billion from our founding to our first FDA approval,” he said. “Bringing a drug to market is a lengthy, expensive, and risky endeavor, costing on average upwards of $2 billion and taking over 10 years.”

Meanwhile, only 10% of drugs under development even reach the market.

How to help biotech SMEs

The Tax Relief for American Families and Workers Act (H.R. 7024), passed by the House earlier this year, would restore a deduction to ensure companies are not taxed on R&D before earning revenue on drugs in development, Watanabe said.

“Another way to help small and mid-sized biotechs is to unlock their Net Operating Losses (NOLs). Due to the high costs of drug development, small biotechs generate substantial NOLs over the course of bringing a product to market,” Watanabe said. “Allowing smaller biotechs to receive the value of a portion of these NOLs immediately could provide much-needed funding at a time when capital is both essential and scarce. In addition, reforming Section 382 so small biotechs’ NOLs are not limited if they accept new investment would preserve these valuable tax assets.”

Additional tax measures could include “creating and expanding incentives like the capital gains exemption under Section 1202 for Qualified Small Business Stock for investment in exceedingly risky areas like biotech,” he said.

SMEs can benefit from non-tax measures too, including laws strengthening patent protections and reauthorization and expansion of the Small Business Innovation Research (SBIR) and the Small Business Technology Transfer (STTR) grants, which “are critical for early-stage companies,” Watanabe said.

The Utah perspective

BioUtah CEO Cullimore noted the importance of biotech for Utah, where more than 182,000 are employed in an industry with a total impact of over $22 billion annually on the state economy.

“From 2012 to 2022, the number of jobs in Utah’s life sciences industry increased by 5.1% per year on average versus 3.5% in other states, and 3.4% in other Utah industries,” said Cullimore’s written testimony. “Utah’s life sciences industry has been the third fastest growing bio innovation hub in the nation over the last decade. Only Massachusetts and Arizona grew at a faster pace.”

An important issue for biotech in the U.S. generally, and Utah specifically, is the need for policy supporting mergers and acquisitions (M&A).

“In Utah, life sciences M&A is a critical pathway that attracts sustained investment, R&D, and growth,” he testified. “Researchers at the University of Utah and Utah State University were awarded 824 life sciences patents and launched 35 life sciences startups from 2018 to 2022. Small businesses make up the vast majority of Utah’s life sciences hub. These companies may rely on M&A to gain the resources and scale needed to bring their innovations to patients.”

Since 80% of biopharmaceutical companies operate without a profit, they need to merge with other firms to obtain the necessary funding and capabilities.

Cullimore called on Members of Congress to recognize the importance of M&A and consider actions “to counter the current aggressive approach” against M&A from the Federal Trade Commission and Department of Justice, which “could inadvertently stymie pro-competitive M&A.”

What lawmakers said about biotech

“Looking ahead to 2025, this Committee is exploring how the tax code can better facilitate innovation, especially in the biotech industry,” said Chair Smith. He asked for specific suggestions.

Watanabe mentioned the R&D tax deduction, preserving and expanding Section 1202 to encourage investment in small biotechs, and measures enhancing the monetization of NOLs.

Rep. Blake Moore (R-UT) asked to hear more about NOLs.

“The NOL monetization concept is very important for early-stage companies because, as they’re doing research, they’re building up these losses,” said Cullimore. “The ability to monetize those, either through a device of being able to market those like a tax credit can be marketed or to be able to utilize those like an earned income tax credit on a personal tax return, generates capital that further advances their work.”

“We’ve generated something like a billion dollars in loss trying to get our first product to market before we generated a single dollar of revenue,” said Watanabe about Arcutis. “You can’t use your NOLs until you’re profitable. I would hope that, maybe some time in the next five years, I’ll be profitable, but that’s a long time to be sitting in that hole. Our ability to sell our NOLs to another company and bring that money to invest in R&D immediately would make a huge difference.”

Rep. Kevin Hern (R-OK) said he proudly co-sponsored the ORPHAN Cures Act. He asked whether Watanabe thought it would be useful.

“Some of the best cures for these rare diseases are repurposed from different initial indications. Companies are not pursuing those follow-on indications anymore, precisely, as you said, because the IRA creates this disincentive,” Watanabe responded. “Your ORPHAN Cures Act is an incredibly important fix to the IRA and we really hope that we see passage of that bill very soon, because every day that this disincentive is in place is a day that new innovations aren’t being developed for people who are suffering from rare diseases.”

Featured Photo: Arcutis Biotherapeutics President and CEO Frank Watanabe, left, and BioUtah President and CEO Kelvyn Cullimore, at the hearing in Salt Lake City.