Market concentration allows pharmacy benefit managers (PBMs) to siphon off funds from our health care system while increasing costs to patients and reducing access to medicines, witnesses and lawmakers told a Sept. 11 House hearing.

Participants discussed how PBMs profit from anticompetitive practices that drive up prescription drug prices at the hearing, held by the House Judiciary Subcommittee on the Administrative State, Regulatory Reform, and Antitrust.

“The three largest PBMs account for nearly 80% of the market for pharmacy benefit services. The top three PBMs are members of vertically integrated companies that also own insurance companies, provider groups, and pharmacies,” said Rep. Dan Bishop (R-NC).

PBMs profit by taking rebates from drug developers in exchange for including their medicines in the formulary of drugs covered by health plans. PBMs drive up the cost of drugs for patients while reducing access by limiting the number of drugs covered by insurers, inflating the prices of drugs, and forcing the closure of pharmacies—leaving communities underserved.

How we got here

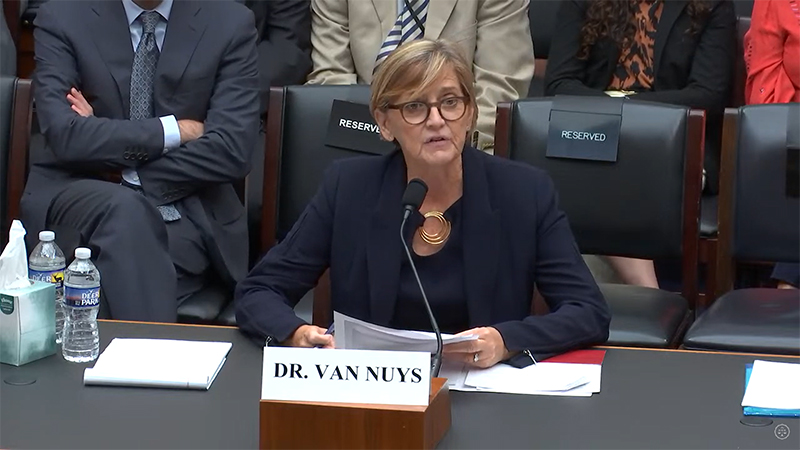

“PBMs emerged as simple claims processors in the 1960s but have evolved to become key intermediaries in the pharmaceutical supply chain,” according to hearing testimony provided by Karen Van Nuys, Executive Director of Value of Life Sciences Innovation at the USC Schaeffer Institute.

“Today, they manage drug benefits for health plans and employers, negotiate rebates with manufacturers, design formularies, develop and maintain pharmacy networks, and process prescription claims,” Van Nuys testified. “This evolution has been marked by significant consolidation and vertical integration with other parts of the healthcare value chain, fundamentally changing the industry’s dynamics.”

The market distortions have drawn criticism from the Federal Trade Commission (FTC), which recently released an interim report noting the largest PBMs belong to the same companies as insurers and pharmacies.

As Subcommittee Chair Thomas Massie R-KY said during the Sept. 11 hearing, there is bipartisan agreement that PBM reform is needed. Rather than engaging in a politicized hearing, “we’re working for the people today,” he said.

Antitrust at issue

The hearing was an opportunity for the House Judiciary Committee to focus on the quintessential antitrust issue of PBMs through the lens of its antitrust jurisdiction.

“The antitrust problem is that the PBM is either self-serving or serving the people that they’re contracting with, and not serving the patient,” Rep. Deborah Ross (D-NC) told the hearing. “Yeah, there might be some savings, but they’re either going back to the insurance company or they’re going to the PBM. And that doesn’t accomplish the goal. That is the antitrust problem.”

Subcommittee Ranking Member Luis Correa (D-CA) displayed a chart showing what he said was an intentionally complex and opaque system of PBM involvement in drug access and pricing. He noted that manufacturers can make many payments to PBMs on a single drug, and participation by group purchasing organizations, aggregators, pharmacy service administration organizations, and others drive up costs.

“One thing is certain, things just ain’t right,” he said. “There are too many hardworking Americans who can’t afford medications.” Beyond raising prices, PBMs reduce patient access in other ways, participants said.

“Over the last decade, PBMs have increasingly restricted patients’ access to therapies through utilization management policies like prior authorization, step therapy, and formulary exclusions,” which involve denying coverage for certain drugs, explained USC’s Van Nuys.

“Formulary exclusion, the most extreme form of utilization management, has been imposed especially aggressively: By 2020, Medicare plan formularies excluded an average of 44.7% of brand-name-only compounds,” she said.

BIO supports PBM reform efforts

During the hearing, Rep. Ross mentioned that she is sponsoring a PBM transparency bill through the House Energy & Commerce Health Subcommittee.

Several bills to Improve transparency and increase regulation of PBMs have been introduced in the House and Senate, and the Biotechnology Innovation Organization (BIO), has actively supported legislative reform.

“The PBM industry evolves so quickly—always in the direction of ever-greater profits for the giant health insurers that own them—that half-measures won’t cut it,” according to an opinion piece by BIO, which calls for broad reform. “PBM business practices should first be understood in terms of the patient experience. PBMs restrict access or divert funds that could otherwise alleviate the burden for patients at the pharmacy counter.”