As weakening investment plagues small, innovative biotechs on both sides of the Atlantic, one bright spot in providing funding is acquisitions—though even that vital source of support faces some regulatory headwinds, according to David Thomas, SVP of the Biotechnology Innovation Organization (BIO), at 2023 BIO-Europe.

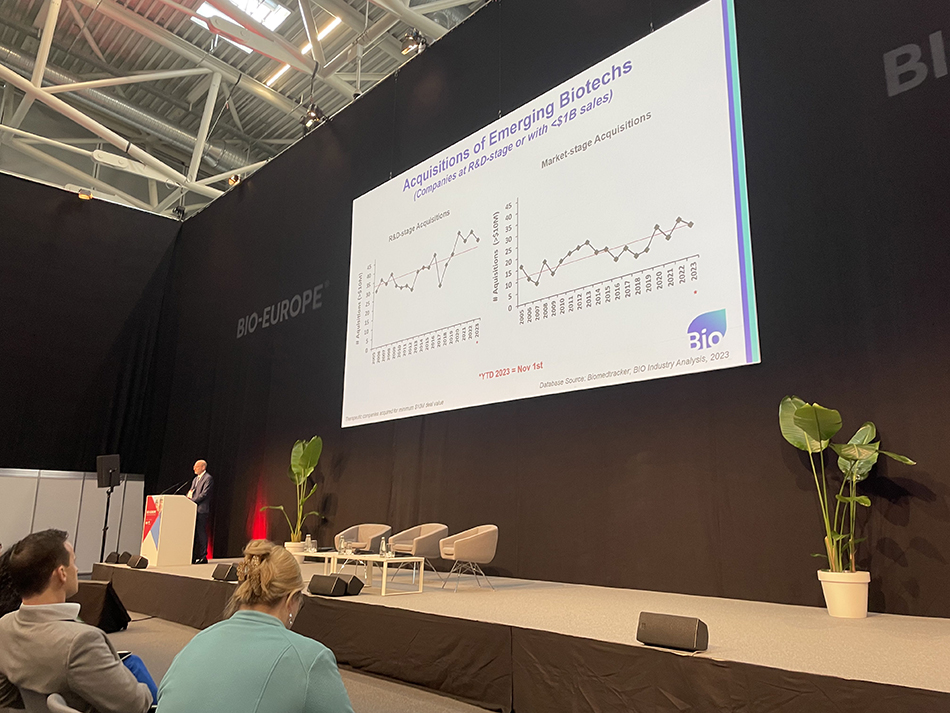

“In 2023, with two months to go, we’re likely going to end the year at average or above average for acquisitions,” said Thomas, explaining the biotech deal-making landscape during the opening session of BIO-Europe in Munich on November 6. “Looking at the dollar amount spent each year, you see that recently it has not been just average, it has been above average. And in fact, this year could be a record spend on the acquisitions of R&D stage companies.”

Acquisitions and deal-making were front-of-mind for most of Thomas’s audience. They had come to 2023 BIO-Europe to engage in Europe’s premier partnering event for biotech, sponsored by BIO and EBD Group. A record 5,876 attendees were about to take part in tens of thousands of prearranged face-to-face meetings to make deals.

Challenges for emerging biotechs

Partnering is especially important in an environment where external investment is hard to come by, said Thomas. He noted that the stock market has been a declining source of biotech investment for the last few years, as even good prospects have a hard time selling shares.

“One of the quotes I heard from an investor in New York last month was that positive data is no longer enough,” Thomas said. “You have to have exceptional data these days to go with the initial public offering, secondary offering, or even to keep your stock price from falling.”

Meanwhile, venture capital is also becoming more scarce for biotech, with the drop even more pronounced in the United States than in Europe. This is especially true for new startups, Thomas said.

“First-time financing has become very difficult to get as traditional biotech VCs add to their positions in clinical stage companies, leaving a lot of those preclinical startups without funding,” he continued.

Acquisitions and regulatory hurdles

Even the one positive area, mergers and acquisitions, faces regulatory headwinds.

“Unfortunately, governments this year have stepped in and tried to block M&A in our sector, with the United States even suggesting they would go further into large licensing transactions and block those,” Thomas said.

He gave the example of Amgen’s acquisition of Horizon Therapeutics, noting that the Federal Trade Commission (FTC) sued to block the merger earlier this year, potentially dampening the appetite for biotech M&A activity.

“Why would they do this? Why are governments trying to stop a core part of our ecosystem when in cases like this, there is no competitive overlap or even pipeline overlap?” Thomas asked. “Turns out the government regulators are speculating that acquisitions in our industry are giving the buying company too much power with respect to patient access and the cost of medicines.”

BIO saw the FTC interference as “obvious overreach,” filing an amicus brief.

“After our efforts this year, the U.S. government dropped their lawsuit against Amgen, and the deal has been allowed to go through,” Thomas said. He promised that BIO will continue its efforts to defend dealmaking.

BIO recently submitted comments to the FTC as it pushes for a regulatory environment that is more receptive to the kind of dealmaking that is essential to biotech.

For now, there is funding available for acquisition deals, and the attendance at 2023 BIO-Europe indicated an appetite to make deals.

“With cash balances of the top 20 pharma now at $200 billion, there’s a lot of dry powder out there,” Thomas said. “There is interest and motivation for more transactions as evidenced by the dozens of buy-side firms here today.”