A year ago, the sentiment for the industry was extremely low. In 2023, the biotech stock indices were sliding to potential new lows, levels not seen since 2017. Everything from venture capital to licensing was trending down significantly, and we were coming off the heels of the newly passed Inflation Reduction Act (IRA). It was hard to find positive signals to present at events such as BIO-Europe.

But things have changed heading into 2024.

In Barcelona last week, I had a string of positive trends to report in my opening remarks at BIO-Europe Spring 2024. Heading into the event, the S&P Biotech Index broke through levels not reached in two years. After hitting the $100 mark in late February, the XBI ETF pulled back in March but still remains up 40% in less than five months.

Positive signals can also be seen in recent IPO capital raised and post-IPO performance. There is also a very strong secondary market to point to, with Private Investments into Public Equity (PIPEs) and Follow-on Public Offerings already reaching the third-highest level ever for a first quarter.

So, what is driving this resurgence in investor interest? I proposed five reasons for why this might be taking place.

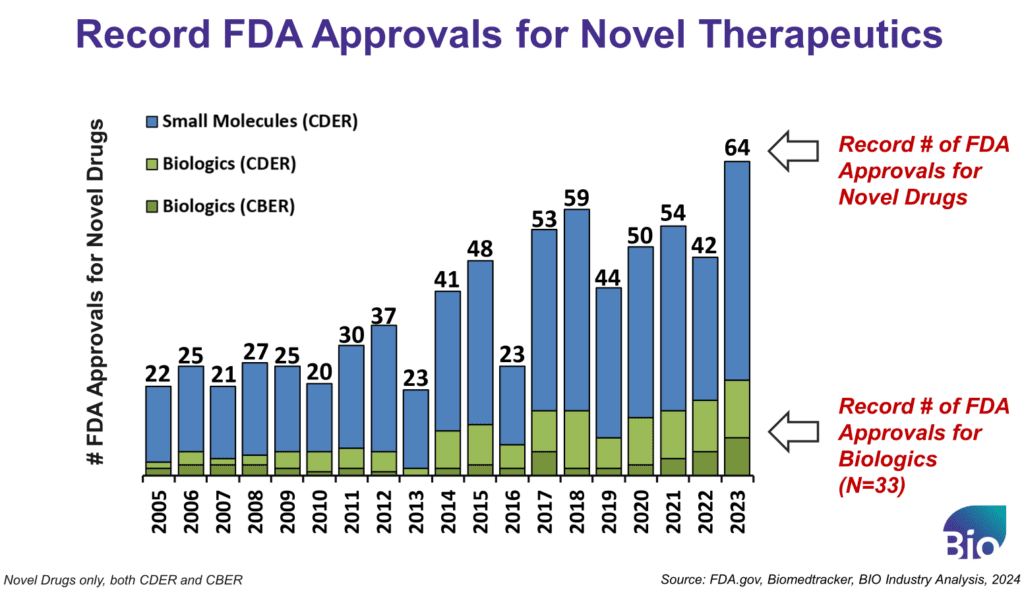

1. Record FDA Approvals

First, investors are pointing to the industry’s output with a record number of FDA-approved therapeutics – reaching 64 last year when you combine the number of novel approvals from the Center for Biologics Evaluation and Research (CBER) and Center for Drug Evaluation and Research (CDER). Many of these, in fact, 65% of the new drugs, originated in small companies. This demonstrates the promise and importance of biotechs in the drug industry ecosystem.

Within last year’s approvals, we also had a record number of biologics approvals. These were not just antibodies and ADCs (which have also been driving positive headlines in the last year and could arguably be a separate reason for investor enthusiasm), but we saw a record level of approvals for nucleic acid-based drugs. With four different RNA modalities, three ex vivo gene therapies, and two in vivo gene therapies approved last year, there is renewed excitement about how this former pipeline story about genetic medicines is now actually impacting patients in the real world.

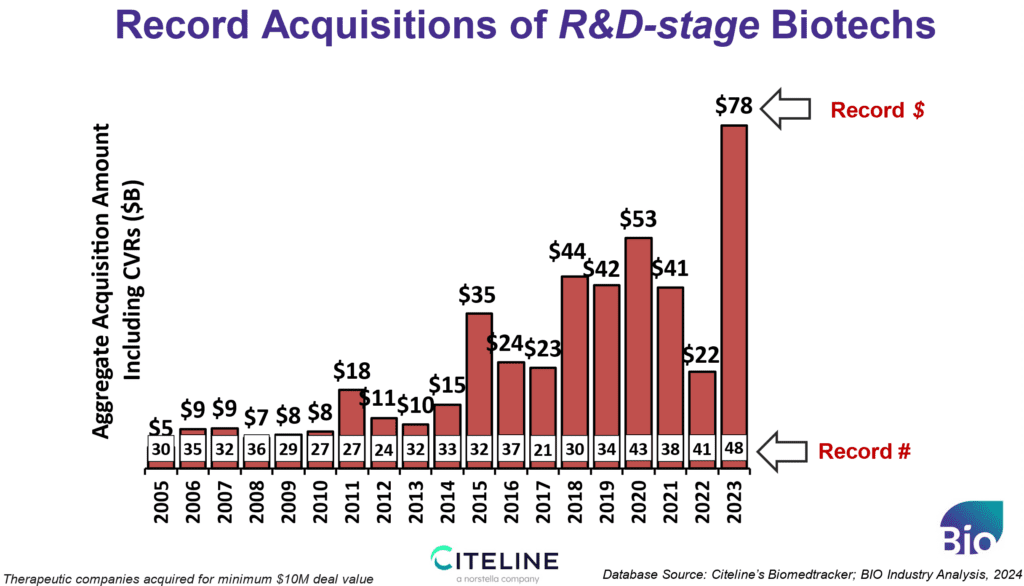

2. Record Acquisitions

Secondly, we can point to record acquisition activity. In 2023, R&D-stage acquisitions accounted for $78 billion of spending, far above the previous record set at $53B in 2020. Another record was set for the number of emerging biotechs acquired (for those worth a minimum of $10 million), at 48 – which is five more than we saw at the last peak. In 2024, we already have 17 R&D-stage acquisitions. Surprisingly, the acquisitions were not just focused on cancer and rare disease as has been the case in recent years, but we ended the year with two sizable CNS acquisitions signaling a broader interest by Pharma that includes chronic diseases. These acquisitions are key to the ecosystem and are instrumental in recycling investor funds for redeployment to new ideas and the next generation of medicines. Let’s hope the Federal Trade Commission (FTC) does not destroy this activity with its increasing interest in filing lawsuits that seek to block acquisitions and licensing transactions.

3. Obesity Drugs

Perhaps nothing is getting as much attention and driving sentiment as the industry’s breakthroughs in treating obesity and other cardio-metabolic diseases. Just last week we saw the first drug approved by the FDA for MASH, a form of metabolic dysfunction of the liver. Investors have been witnessing frequent top-line trial data from obesity drugs tested for additional indications. With growing applications, analyst estimates place the obesity drug market north of $100B in 2030 from just $3 billion a few years ago.

There are not too many other industries where the addressable market can change that dramatically in such a short time. A shift like the one taking place in obesity, where headlines drive broader attention to biotechnology, tends to drive the sector upward. This is somewhat reminiscent of what we saw during COVID when rapid success with vaccines drove record levels of investment into cancer and other areas completely unrelated to infectious disease.

In terms of the impact such a sea change can have on R&D, consider that when I presented data on this topic at BIO-Europe Spring back in 2019, there was not a single obesity drug in Phase III. Today, not only do we have the approved GLP-1s, but we have six new drugs in Phase III following closely behind and an overall 160% increase in Phase I & II, based on new data from CITELINE.

4. AI for Drug Creation

As for the fourth trend in the spotlight, you may have noticed that broader stock markets have been reaching all-time highs in large part driven by trillion-dollar tech companies Nvidia, Google, Microsoft, and Meta. A significant reason for this is that they are in the midst of a competitive land grab for artificial intelligence. But when investors listen closely to the tech game plan, they note the AI strategy now includes Drug Development. Large biopharmas have also been joining this race and either striking deals with the tech giants or partnering with the AI biotechs. This is occurring at an increased pace pushing AI drug discovery deals to a record in 2023.

2023-2024 is actually experiencing a second wave of biopharma activity within AI. Unlike the first wave, just prior to COVID. We are now seeing a giant leap in our understanding of where this nexus of tech and biotech can take us. With breakthroughs like Alpha-Missense (released just 6 months ago from Google’s DeepMind*), and ESM-Fold (released in 2022 by Meta), we now have the predicted 3D structures for drug targets that were unimaginable just two years ago and we have the ability to structurally pinpoint rare mutations linked to diseases.

In the last year, we have seen the first drug created by Generative AI reach Phase II clinical studies driven by Insilico Medicine. We also saw the first antibody fully designed by Generative AI without using wet lab training data on the target of interest- work published by the company ABSCI last year.

These are all signals that things are changing rapidly in our industry and long-term investors have noted that the net result here will likely be an increase in probability of success which translates to less cost and less time to market.

5. Policy Progress

The IRA continues to cast a shadow over the industry, but the Biotechnology Innovation Organization (BIO) has been leaning into the issue with proposed technical changes to the law – and these have now been packaged into legislative bills. This is an important first step.

For example, we have supported bills that keep drugs with secondary orphan indications exempt from price controls and supported changes to the law that remove the bias against small molecules.

BIO has also been supporting two financial issues that are now moving in the right direction in Congress: a reversal of R&D amortization accounting rules, and exemptions from onerous SEC reporting requirements for small companies.

BIO has also been a successful industry voice recently across continents protecting intellectual property rights so companies can efficiently manufacture and deliver life-saving innovations to patients around the world. Access and innovation often require cross-border collaboration, and this is one of the reasons we host the BIO International Convention, where this year we expect more than 40% of attendees will be from Europe, Asia, and South America. This will be the largest partnering event in the industry, and with more than 150 panel sessions, we plan to leave no topic off the table.

With BIO’s Convention coming up June 3-6, 2024, in San Diego, we hope you can register and find time on your schedule to join us for more on the positive impact this industry is making. Visit convention.bio.org to register and learn more.

* AlphaFold2 was released in 2022, predicting essentially all known sequences in the Protein Data Bank (PDB), which implies more than 200 million proteins.