If you are a regular reader of Bio.News, you likely know that the past two years have been difficult for the biotech market. Investor skepticism grew, valuations dropped, and deals became rarer.

We need a rebound this year to grow companies and bring more products to market, and there are some indications that such a change is on its way.

Valuations fell, but biopharma responded well to early-stage innovation

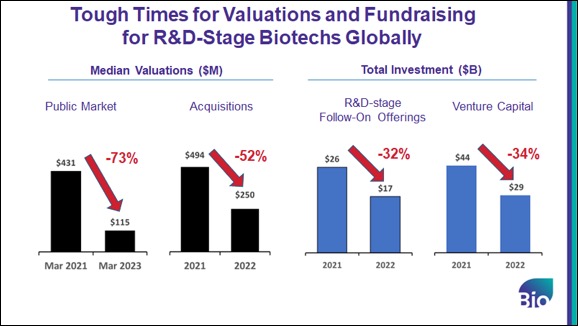

First, what happened? From March 2021 through March 2023, public valuations for R&D-stage biotechs fell from a median of $431 million to $115 million—a drop of 73%. Moreover, from 2021 to 2022, the valuations of company acquisitions around the world fell 52%.

As valuations fall, new financing tends to get difficult, and the current environment is no exception. Public share offerings, for both IPOs and follow-on offerings, plummeted for R&D stage companies in 2022. In private markets, venture financing slowed as well. Globally, the amount raised declined from $44 billion in 2021 to $29 billion in 2022, with Europe and Asia falling far more than the United States. Even out-licensing deals for clinical-stage assets, which are often biotech partnering collaborations with larger biopharmas, experienced their steepest drop in at least 15 years in 2022.

Two bright spots emerged, however:

- While the number of out-licensing clinical-stage deals declined, completed deals held strong terms in their deal structure with large upfront payments. That means biopharma is still willing to commit significantly when they see the right asset.

- Out-licensing deals for pre-clinical stage deals grew both in terms of the number of deals and total upfront dollars. This suggests biopharma’s thirst for early-stage innovation and access to new platforms remains strong.

Adverse combination factors take time to resolve

As we know, change doesn’t happen in a vacuum, particularly in our industry. A post-COVID hangover affected the sector, as did speculation about—and eventual passage of—the Inflation Reduction Act in the U.S. More recently, small biotech valuation gains over the past six months have been reversed by the collapse of financial institutions that catered to the industry.

I’ve seen market downturns in biotech during the 2000 tech bubble, the 2008 global financial crisis, and during the heated drug pricing debate of 2015-2016. I also witnessed biotech’s reemergence after all three events. For each of these downturns, the macroeconomic or political environment became less uncertain before investment and deal-making interest returned.

Although follow-on offerings tend to bounce back when the overall market recovers, biotech IPOs, venture investment, and licensing activity tend to take longer to recover. For example, IPOs and deal-making after the 2008 financial crisis did not rebound for another five years, whereas follow-on offerings were up and running by 2010. In 2015-2016, the shock of a 45% drop in the S&P Biotechnology Index was short-lived, as the November election results ended a significant amount of political uncertainty. In these scenarios, it was either a shift out of a deep recessionary environment or the removal of an anti-industry political outlook that returned confidence to investors. Confidence in the system, both economic and political, was needed for investors to take on the required risk of allocating capital to biotech.

The current investment situation is unfortunately marred by a combination of inflation, higher discount rates, threats of a recession, a supply-shock inducing war, and—to top it off —a political rollout of anti-free-market legislation for the drug industry. All of these factors are a lot to reverse before the industry climbs back to a healthy investment and deal-making volume, let alone to 2021 highs in the biotech index.

Building momentum is key to biotech’s rebound

While the Biotechnology Innovation Organization (BIO) cannot affect macroeconomic cycles, it can play key roles in strengthening industry investment and improving the political environment in which we do our life-saving work. The first role is as our industry’s leading advocate in Washington, D.C., state capitals, and internationally. We work to advance and implement laws and regulations that support biotech’s growth and increase its public support, including shaping the implementation of the aforementioned Inflation Reduction Act.

Second, BIO serves as the sector’s leading convener. We hold conferences throughout the year to bring biotech leaders, deal-makers, and investors together, with none bigger than our upcoming 2023 International Convention in Boston this June. At our convention, more than 15,000 attendees will gather to network, partner, and listen to presentations. Our One-on-One partnering team expects to facilitate nearly 50,000 meetings this year.

So while the biotech industry has experienced a financial downturn since 2021, we need to continue to build momentum within the industry to prime, discover, and deploy life-altering innovations. BIO, whether through advocacy, education, or as the sector’s convener of choice, is leading the way. I hope to see you at our convention in Boston this June!