The Federal Trade Commission (FTC) released an interim report on July 9 criticizing the negative impact pharmacy benefit managers (PBMs) have on prescription drug prices and access.

The first major output from an FTC study of PBMs started in 2022, the interim report appears to describe a clear need to address market distortions caused by PBMs.

“The FTC’s interim report lays out how dominant pharmacy benefit managers can hike the cost of drugs—including overcharging patients for cancer drugs,” according to FTC Chair Lina M. Khan. “The report also details how PBMs can squeeze independent pharmacies that many Americans—especially those in rural communities—depend on for essential care.”

Khan said the interim report would soon be followed by a final report. She told reporters the FTC wants to share more details in the next one to three months.

What’s in the FTC’s PBM report?

The key findings include:

- “The market for pharmacy benefit management services has become highly concentrated, and the largest PBMs are now also vertically integrated with the nation’s largest health insurers and specialty and retail pharmacies.”

- “As a result of this high degree of consolidation and vertical integration, the leading PBMs can now exercise significant power over Americans’ access to drugs and the prices they pay.”

- “Vertically integrated PBMs may have the ability and incentive to prefer their own affiliated businesses, which in turn can disadvantage unaffiliated pharmacies and increase prescription drug costs.” Vertical integration includes the above-mentioned integration of PBMs with health insurers and pharmacies.

- “Evidence suggests that increased concentration may give the leading PBMs the leverage to enter into complex and opaque contractual relationships that may disadvantage smaller, unaffiliated pharmacies and the patients they serve.”

GPOs cause concern

The report also gives specific focus to the issue of group purchasing organizations, or “GPOs.”

“These entities, however, are not traditional GPOs that purchase drugs and other medical supplies on behalf of health care providers like hospitals. Rather, the entities—which we refer to as ‘rebate aggregators’—negotiate contracts, including rebates, with drug manufacturers,” the report says.

“Internal PBM documents appear to show novel methods of fee generation from these new rebate aggregators. One report estimates that since the PBMs spun off their rebate aggregators, they have extracted from drug manufacturers billions of dollars in additional fees, which doubled from $3.8 billion in 2018 to $7.6 billion in 2022,” the report says. “Other reasons given by commentators for the creation of these new rebate aggregators include to avoid potential regulatory or legislative PBM reform.”

Though it does not prescribe any major action. Further reports with more detail are expected soon. The FTC did not rule out taking action in the future.

“The FTC will continue to use all our tools and authorities to scrutinize dominant players across healthcare markets and ensure that Americans can access affordable healthcare,” said Khan.

The interim report and the coming final report will also inform Congress, where there have been several proposals for PBM reform.

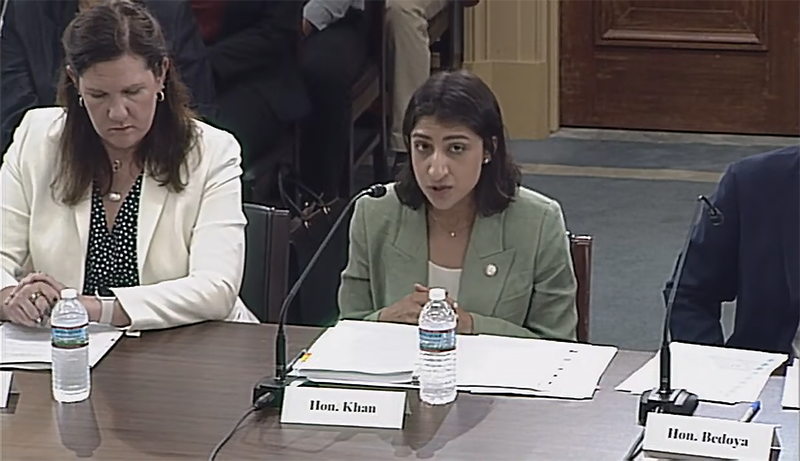

FTC Chair Khan testifies on Capitol Hill

On July 9, the day the interim report was released, FTC Chair Khan testified at a House Energy & Commerce Innovation, Data, and Commerce Subcommittee Hearing on the FTC 2025 budget. Several Members of Congress discussed the report and the FTC investigation of PBMs.

Rep. Larry Bucshon, M.D. (R-IN) was interested in GPOs. “Very little is known about these GPOs except that they’ve created new revenue streams for PBMs and insurers that own them,” he said. Khan said the investigation of GPOs is continuing as part of the PBM study.

“PBM practices that keep patients away from the drugs that they need,” is a major concern, said Rep. Diana Harshbarger (R-TN). “PBMs have failed to reimburse pharmacies for years. It’s led to pharmacy deserts. People can’t find a pharmacy because they put the independents out of business.”

Rep. Mariannette Miller-Meeks (R-IA) noted that the six largest PBMs control over 90% of prescriptions filled in the United States today. The system “continues to allow middlemen to squeeze independent pharmacies and patients, all at the expense of access,” she said.

Rep. Earl L. “Buddy” Carter (R-GA) said he has been asking FTC for this report since he joined Congress nine and a half years ago. He congratulated FTC for getting this study underway in 2022 and finally sharing some results.

Image: FTC Chair Lina M. Khan tesifies at a July 9 House Energy & Commerce Innovation, Data, and Commerce Subcommittee Hearing on the FTC 2025 budget.