U.S. Senators have been busy this week understanding and pushing forward PBM reform. On May 10, the Senate Health, Education, Labor, and Pensions (HELP) Committee explored the role of PBMs—pharmacy benefit managers—in insulin prices. The following day, May 11, the HELP Committee, better informed from the day before, jumped back into their markup of several bills, notably the PBM Reform Act.

Watch BIO’s take on the markup—and keep reading for more on what’s next for PBM reform.

Hearing: The role of PBMs in insulin prices

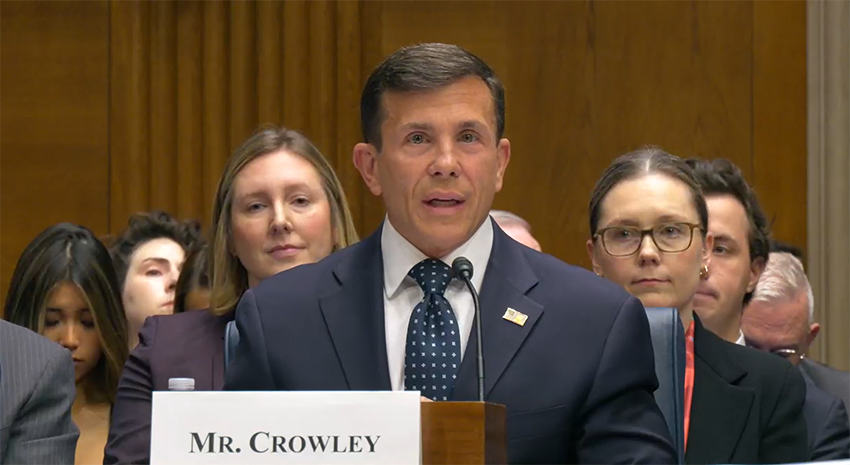

The May 10 hearing brought together biotech and PBM CEOs for testimony about insulin prices. The role of PBMs featured prominently.

In their testimony, the three CEOs of CVS Health, Express Scripts, and OptumRx called PBMs a “counterweight” to manufacturers, claiming as much as 98% of rebates are passed to “clients.”

Claims (or rather implications) that the CEO’s made stating that PBMs help patients are poorly substantiated and not well supported by later testimony—this was exemplified by the CEOs repeated use of the term “client,” which really meant “insurance company.” While PBMs did act as a more genuine middle-man in the pre-Affordable Care Act years, since 2010, the top PBMs have cornered the market and seen their profits soar—with patients left footing the bill.

“The largest PBMs are vertically integrated with health insurance companies and specialty pharmacies, giving them financial incentives to steer patients to use their affiliated services,” the Federal Trade Commission (FTC) has explained.

As Wendell Potter, former vice president of corporate communications at Cigna, writes, “Cigna now gets far more revenue from its PBM than from its health plans. CVS gets more revenue from its PBM than from either Aetna’s health plans or its nearly 10,000 retail stores. UnitedHealth has the biggest share of both the PBM and Medicare markets and, through numerous acquisitions of physician practices, is now the largest U.S. employer of doctors.”

Meanwhile, PBMs kept 13% more of the rebates than anticipated in 2021, we previously reported.

For example, in “2021, only $11.9 million (0.2%) out of $5.7 billion in manufacturer payments were shared as point-of-sale savings to plan beneficiaries” in Texas, Drug Channels’ Dr. Adam J. Fein has explained.

Another issue during the hearing was the question of exactly what drugs were allowed on insurance formularies and what role that played in drug costs. “I’m told pharmaceutical companies try to offer lower cost products, but PBMs turn them down,” said Sen. Tim Kaine (D-VA). “What low-cost product did Sanofi have that was not accepted by the system?”

Paul Hudson, Chief Executive Officer of Sanofi, responded, “Unbranded Lantus was launched at a 60% discount, but was not listed on health plans. [The reason why] is between the PBM and the health plans.”

David Ricks, Chair and Chief Executive Officer of Eli Lilly and Company, and Lars Fruergaard Jørgensen, President and Chief Executive Officer of Novo Nordisk, echoed Hudson. “It seems clear lower prices are not preferred by PBMs,” said Ricks. “We have had similar issues for unbranded versions. We were not told why,” added Jørgensen.

Sen. Susan Collins (R-ME) noted that the savings seemed to go to the PBMs and plan moderators. She also noted that while insurers say the method keeps rates lower for everyone, it makes the sick subsidize the healthy—a practice Dan Durham, Executive Vice President of Health Policy at the Biotechnology Innovation Organization (BIO), has described as “reverse insurance.”

Summing it up: “PBMs are owned by insurance companies, so PBMs rebate themselves,” said Sen. Markwayne Mullin (R-OK). Watch:

Markup: The PBM Reform Act

On May 11, the markup of the PBM Reform Act continued. As a result of the hearing the day before, several amendments were added, pulled, and edited.

One issue that kept coming up was spread pricing, which Sens. Rand Paul (R-KY) and Mitt Romney (R-UT) were especially keen to address. Spread pricing “is the PBM practice of charging payers like Medicaid more than they pay the pharmacy for a medication and then the PBM keeps the ‘spread’ or difference as profit,” as explained by the National Community Pharmacists Association (NCPA), who does not support the practice.

“As pharmacy reimbursement rates are ratcheted down, pharmacy providers are frequently reimbursed at rates that leave them ‘underwater’ on the medications they dispense. Eventually, this leads to drastic negative effects on pharmacy providers as well as the vulnerable Medicaid beneficiaries who they serve,” says NCPA.

“Meanwhile, Medicaid budgets are soaring. States have found under their Medicaid program that as a result of PBM’ spread pricing’ the program was being billed for more than the total price paid to pharmacies for actual claims,” continues NCPA.

Spread pricing made an appearance on May 10, as well. “It’s clear from testimony that banning or not using spread pricing would lower costs by 3.5 percent,” Sen. Bill Cassidy (R-LA) commented.

“An article about spread pricing reports Medicare Part D paid an average of $22.50, and $3.80 went to pharmacy, $2.71 went to the wholesaler, $6.73 went to the manufacture, and $9.18 went to the PBM.” Continuing that someone who looked at the commercial market said the average spread is $11.50.

“Testimony says the average person in a high deductible health plan pays $18.60 for a prescription, but in a high-deductible health plan, you have that initial deductible and additional drug spend throughout the year. Have you looked at the average cost of a drug when someone is in their deductible?” he asked the PBM executives.

What amendments were adopted?

Offering committee members the chance to offer amendments, the committee nonetheless agreed to table amendments they believed would jeopardize bipartisan passage in committee and on the floor, amendments that didn’t have a Congressional Budget Office (CBO) score, and amendments that hadn’t received Technical Assistance (TA) numbers.

Sen. Rand Paul (R-KY) offered two amendments, expressing concerns about banning spread pricing:

- Sen. Paul’s Amendment 1 would have repealed the Robinson-Patman Act, part of the antitrust legislation found in the Clayton Act of 1914. Sen. Paul expressed concerns about banning spread pricing and its impact on small businesses.

- Sen. Paul’s Amendment 2 focused on antitrust re-collective bargaining to benefit pharmacies/pharmacy services administrative organizations, and physician providers.

Both amendments were ruled out of order as the Senate HELP Committee was not the jurisdiction that addressed those issues; these need to go under the review of the Judiciary.

At one point, Sen. Paul proposed completely stopping the PBM legislation from moving forward, but this was averted by the committee.

Meanwhile, Sen. Mitt Romney (R-UT) proposed to preserve the option for small to mid-sized employers to choose spread pricing but require PBMs to offer non-spread, as well. He also spoke to allowing consenting entities to enter into contracts they believe benefit them most with a fair amount of transparency. However, HELP Committee Chair Bernie Sanders (I-VT) motioned to table the amendment, in part because, at the time of its presentation, it lacked CBO and TA numbers. (These came later in the discussion.) Sen. Cassidy supported the motion to table, observing the National Federation of Independent Business (NFIB) does not support a full ban on spread pricing. Ultimately, Sen. Romney’s amendment was tabled.

Seven amendments were ultimately adopted.

Sen. Ed Markey’s (D-MA) Amendment 1 authorizes a Government Accountability Office (GAO) study on the access and affordability of naloxone.

Sen. Lisa Murkowski’s (R-AK) Amendment 1 incorporates the Safe Step Act, which would create an exemption from step therapy protocols. Such protocols require patients to try lower-cost drugs before “stepping up” to a more expensive (and possibly more effective) drug.

“Step Therapy is one terminology for it,” said Sen. Murkowski. “Others know it as fail-first protocols. This requires patients to try and fail on a lower-cost drug before they’re allowed to access the drug that was actually prescribed by their physician. It has potential, as you would imagine, to harm patients you have delayed access to the most effective treatments, sometimes with severe side effects. irreversible disease progression certainly creates additional frustration for patients as they’re seeking treatment.”

Both amendments were creative additions to the bill and were strongly approved by the members of the committee.

The committee voted 18-3 to move the bill forward —meaning that, in the Senate at least, we’re one small step closer to finally addressing PBM reform.