Orphan drugs are the fastest-growing segment of the pharmaceutical market, but the Inflation Reduction Act (IRA) clouds the future of new treatments for rare diseases, says a report released last month by Evaluate.

Orphan drugs are drugs that target rare diseases, which are defined as diseases that affect fewer than 200,000 people in the United States. Given the small patient population of rare diseases, there would normally be less incentive to invest in these drugs as the market is smaller. That’s why the 1983 Orphan Drug Act (ODA) encourages development of orphan drugs with tax incentives for research and development. The incentives seem to be working.

“Orphan drugs have outgrown their non-orphan counterparts for each of the last ten years, apart from 2021 and 2022, which were boosted by COVID-19. Even a pandemic affecting the global population didn’t fundamentally alter orphans’ trajectory,” according to Evaluate.

While the sales value of non-orphans will grow 7%, orphan drugs are expected to grow 12% by 2028, achieving $300 billion in sales and nearly 20% of non-generic sales, Evaluate reports.

Market trends

A few interesting trends that the report notes include:

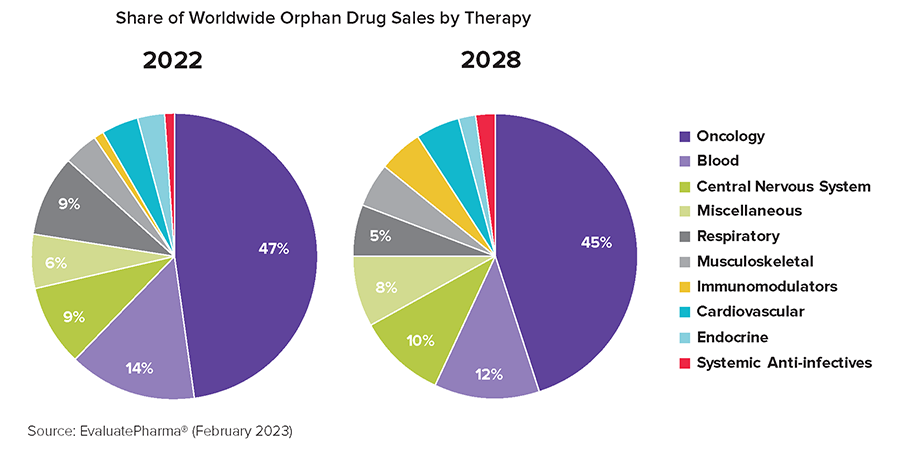

- Oncology drugs make up half of the top ten selling orphan drugs, “reflecting cancer’s unwavering dominance of the orphan space.”

- The Food and Drug Administration (FDA) approved more orphans than non-orphans in four of the last five years. In 2022, the figure for FDA’s Center for Drug Evaluation and Research (CDER) was 54%, the highest yet.

- “Orphans’ trajectory also captures technological progress. Newer modalities such as cell and gene therapies, antibody-drug conjugates, or bispecific antibodies are often tested in niche, well-defined conditions that make an orphan designation more likely. These new modalities made up a third of all 2022 CDER and Center for Biologics Evaluation and Research (CBER) approvals. In part as a result, 2022 was the first year ever that FDA biologics approvals (BLAs) outpaced those of small molecules (NMEs).”

Headwinds on the horizon

The IRA could hurt growth of orphan drugs, the report notes. The new law “exempts orphans with just one approved indication from the price controls that will hit other high-cost Medicare drugs,” says the report. This means that drugs treating more than one disease will be subject to price controls.

As a result, patients are already missing out on potential cures. Alnylam, for example, stopped researching whether their nerve damage drug Amvuttra also treats Stargardt, which impacts children’s vision, Evaluate says.

Future legislation, including new price controls, could do more damage to the orphan drug market, the report says. But “tailored reform” is possible, explains the report. “Orphan Drug Act 2.0 could include tiered incentives…and higher tax credits for ultra-rare orphan drugs,” says Ovid Therapeutics CEO Jeremy Levin, a member of the board of the Biotechnology Innovation Organization (BIO) in the report. “As for oncology orphans, they’d need to be handled separately.”