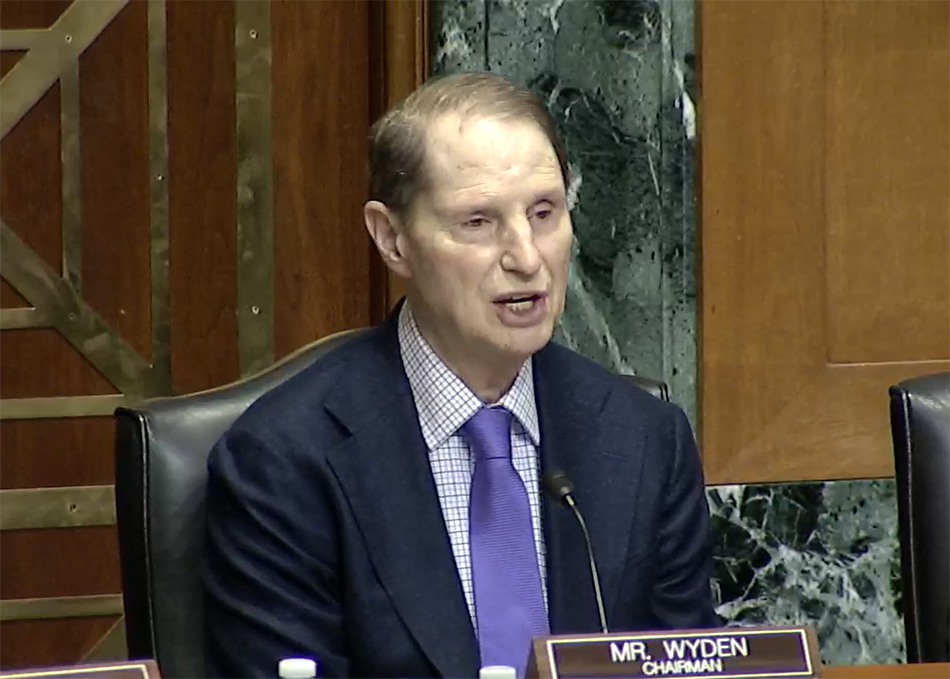

The “benefits” pharmacy benefit managers (PBMs) once provided have been lost, as these organizations now mostly help themselves while driving up drug prices, said lawmakers and witnesses at a March 30 Senate Finance Committee hearing on PBMs.

When they were formed in the 1980s, PBMs originally crunched data to help insurers get the best prices on drugs, but innovations in Medicare created an environment where PBMs could exploit their market power and reap profits, said Committee Chair Ron Wyden (D-OR).

“Rather than act as honest brokers for the health plans, PBMs have acted in their own self-interest. And as it turns out, their own interests are not aligned with low prices. Quite simply, higher prices put more dollars into a PBM’s pockets,” testified UC Law Prof. Robin Feldman.

How Medicare Part D changed PBMs

With the advent of Medicare Part D, “PBMs shifted into overdrive with a larger market and more sophisticated drugs,” according to Wyden’s opening statement for the hearing. “In recent years, it’s increasingly apparent that PBMs are using their data, market power, and know-how to keep prices high and pad their profits instead of sharing the benefits of the prices they negotiate with consumers and the Medicare program.”

Medicare Part D has been a success in many ways, Finance Committee Ranking Member Mike Crapo (R-ID) said in his opening statement. “Part D’s resilient, market-oriented structure continues to ensure low-cost drug access for most seniors, even as many other medical costs have continued to skyrocket,” he said.

Still, Crapo added, there are things that need to be changed in the system. “Certain dynamics seem to drive list prices up, even as net prices, reflective of rebates and discounts, decline,” he said.

According to USC expert Karen Van Nuys, the market distortions of PBMs mean that “Medicare pays 21% more for the most common generic drugs than they would if purchased at Costco.”

Rebates, clawbacks, and spread pricing

“PBMs use several commercial tactics that together may explain those higher costs. One is the copay clawback, in which PBMs collect a patient copay that exceeds the total cost of the drug, keeping the excess,” according to Van Nuys. “A second PBM tactic that raises drug costs is ‘spread pricing,’ in which the PBM pays the pharmacy one price to fill a prescription, then charges the health plan a higher price to settle the same claim, pocketing the difference.”

Meanwhile, PBMs are taking a cut from drug manufacturers. PBMs decide what medicines will be covered by private insurers. If medicines are not covered, patients. To make sure their products are included in the formulary of drugs covered by insurers, drug makers agree to pay rebates to the PBMs, who are supposed to use the rebates they get to lower drug prices for patients, but research shows that’s not happening.

PBMs can choose to pocket the rebates they receive from drug makers, or because the PBMs are often owned by insurers, they can elect to pass the savings on to those insurers. The three largest PBMs control 80% of the market and are all owned by insurers, who benefit when PBMs force drug makers to pay higher rebates.

The solution is transparency

“A PBM may be brokering deals for a health plan, but it is a strange relationship. PBMs refuse to tell the health plans—their own clients—the details of the deals they are making. Neither health plans, nor the government, nor the market has any disclosure,” according to Feldman. “Given their monopoly over pricing information, and the fact that just three PBMs control most of the market, PBMs are setting the terms of almost every arrangement. It is not a free or fair market.”

Feldman suggested the solution is transparency, and that is the goal of legislation currently making its way through the Senate.

As Sen. Chuck Grassley (R-IW) informed the hearing, his reintroduction of PBM transparency legislation, passed out of the Senate Commerce Committee last week.

The PBM Transparency Act aims to ban the practice of “spread pricing,” where PBMs negotiate substantial rebates from drug manufacturers and then charge pharmacies the full price. Additionally, the act mandates transparency regarding the rebates PBMs receive from manufacturers, as well as the fees they charge insurers and pay pharmacies.