This month, the Coalition of State Bioscience Institutes (CSBI) in partnership with TEConomy Partners, LLC published its 2023 Life Sciences Workforce Trends Report. The report’s findings are based on detailed research, including analyzing 2.8 million job postings of life sciences companies over the past four years, as well as a national life sciences survey completed by nearly 700 companies across 18 CSBI/A states and Puerto Rico and interviews with 185 life sciences executives across those same states and Puerto Rico in 2023.

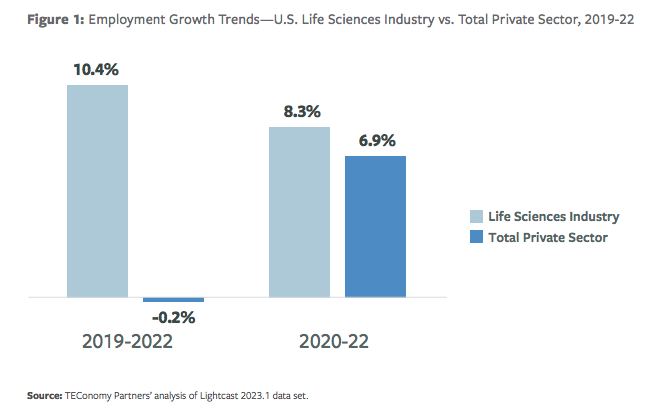

Overall, the life sciences industry remains vibrant in spite of other macroeconomic trends which have negatively impacted other sectors. The industry as a whole grew through 2020 despite—and due to—the COVID-19 global pandemic and continues to outperform the private sector as a whole, as it has done over the course of two decades.

According to the report, from 2019 to 2022, employment in the U.S. life sciences industry grew by 10.4 percent while employment in the private sector as a whole decreased by 0.2 percent. Meanwhile, from 2020 to 2022, the U.S. life sciences industry has increased employment by 8.3 percent, while U.S. private sector growth at the same time was 6.9 percent.

New recruitment and retention tactics

The world of work has dramatically changed in the post-COVID-19 economy, and the U.S. life sciences industry has adapted to this new economic reality. While traditional outreach continues to be done to prospective employees via in-person career fairs and on-campus recruiting, increasingly, the U.S. life sciences has turned to social media networks such as LinkedIn to match candidates to jobs in the industry.

Additionally, U.S. life sciences companies are increasingly prioritizing retention through various different incentives, such as retention bonuses and making broader benefits packages more alluring. There is also greater flexibility regarding an employee’s location, allowing for a broader range of applicants to be considered for roles in the U.S. life sciences industry, particularly in business support roles, such as IT positions.

It seems that hybrid and remote work are here to stay in the post-COVID-19 world, and while this is also true for the U.S. life sciences industry, the details vary by position. Per the report’s hiring survey, 65.9 percent of life sciences companies are implementing, expanding, or considering implementing remote work options for at least some employees. As one life sciences industry executive said in the report, “With COVID, how we worked did change.”

In interviews conducted for the report, no loss in productivity has been detected by several companies which currently have remote or hybrid working arrangements. Furthermore, employees as well as job applicants both clearly desire increased flexibility in work arrangements, and employers are taking note as a way to both retain and attract talent.

A new education economy and industry-academic partnerships

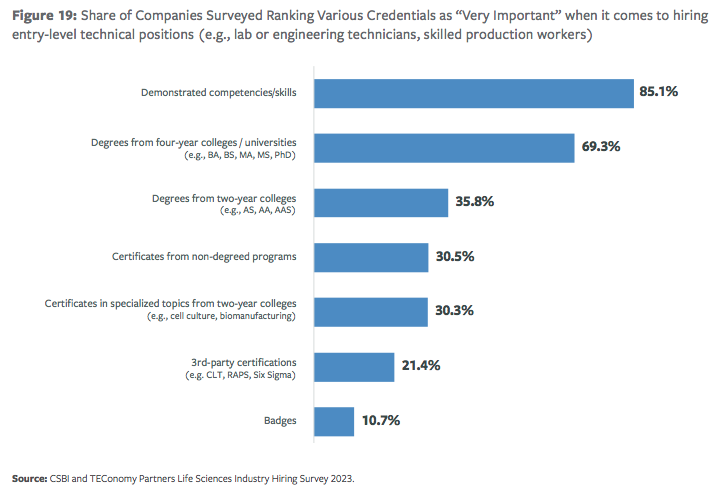

As the U.S. life sciences industry continues to grow, this has resulted in more openness to a wider variety of educational backgrounds being considered in the job application process. The report describes an increased acceptance of a variety of different credentials beyond a four-year degree for new-hires.

Per the companies surveyed, several different credentials were considered “Very Important” when hiring technical entry-level positions. At the top of the list is “demonstrated competencies/skills” at 85.1 percent and degrees from four-year colleges at 69.3 percent. Where the data has notably shifted is with the following: Degrees from two-year colleges are now deemed “Very Important,” by 35.8 percent, while certificates from non-degreed programs and certificates in specialized topics from two-year colleges are at 30.5 percent and 30.3 percent, respectively. Additionally, third-party certifications and badges come in at 21.4 percent and 10.7 percent according to the data.

Another important factor in the ties between industry and academics are both pre-apprenticeship and apprenticeship programs. Pre-apprenticeship programs raise awareness for high school students to start thinking about opportunities in the U.S. life sciences industry while apprenticeship programs offer attractive career opportunities to those who are new to the sector and oftentimes do not have a four-year degree.

Advancing diversity, equity, and inclusion

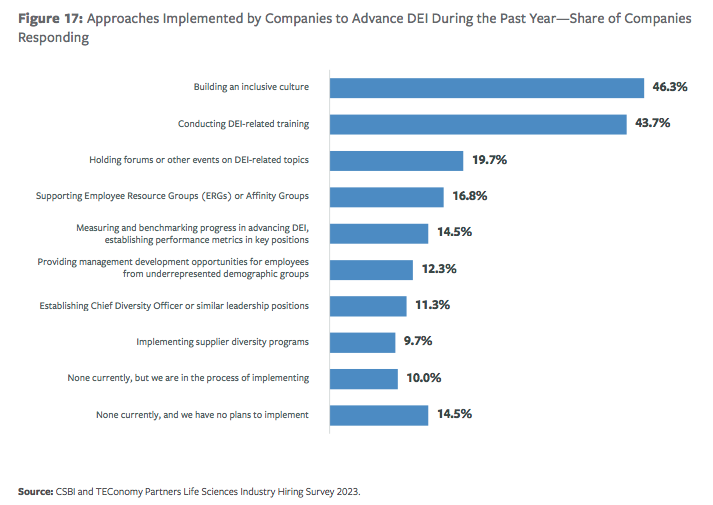

This year’s report shows that the life sciences industry remains committed to advancing diversity, equity, and inclusion (DEI). However, data shows that there is still a notable difference between large and small organizations in how this commitment is advanced, with larger firms having formal programs to move DEI goals forward and smaller organizations where such programs are less formalized.

Per the report, 97 percent of companies surveyed continue to view advancing and supporting DEI as a strategic priority with their views on the matter having either increased or remained the same. This support is manifesting itself in different ways with several companies conducting DEI-related training (44 percent), while others are working to build an inclusive culture (46 percent) and some are holding forums and events on DEI-related topics (20 percent).

It is clear that much of the ongoing commitment to DEI efforts stems from dedication to the issue at the C-suite level and responsiveness to employees. As one executive reported, “…our organization has focused a lot more on DEI in 2022 and 2023 than it ever has before. And it’s not just from the need that the market brings, but our employees have really asked that we focus on it, which is wonderful.”

Much to look forward to

As the report makes clear, there is much to be optimistic about regarding the U.S. life sciences industry. That said, there is room for improvement whether it is in increasing formal DEI efforts or strengthening and expanding industry-academic partnerships. Ultimately, the U.S. life sciences industry is strongly positioned for future growth.