Johnson & Johnson announced Wednesday it is buying the world leader in breakthrough heart, lung, and kidney support technologies, Abiomed, “for an upfront payment of $380.00 per share in cash.”

The transaction, valued at approximately $16.6 billion, was unanimously approved by the Boards of Directors of both companies. Abiomed shareholders will receive a non-tradeable contingent value of up to $35 per share “if certain commercial and clinical milestones are achieved.”

Following the completion of the transaction, Johnson & Johnson “expects to continue to support its stated capital allocation priorities of R&D investment, competitive dividends, value-creating acquisitions, and strategic share repurchases.”

“This transaction partners us with an organization that shares our patients-first mindset and creates immediate value for our patients, customers, employees, and shareholders. It will enable us to leverage Johnson & Johnson’s global scale, commercial strength, and clinical expertise to accelerate our mission of making heart recovery the global standard of care,” said Michael R. Minogue, Abiomed’s Chairman, President, and Chief Executive Officer.

The acquisition is expected to be finalized by the end of the first quarter of 2023.

Abiomed will bolster Johnson & Johnson’s MedTech

The latest acquisition brings significant benefits to Johnson & Johnsn, the world’s largest, most diversified healthcare products company, and a member of the Biotechnology Innovation Organization (BIO).

Last year, Johnson & Johnson decided to split into two publicly traded companies so it can focus on “delivering leading biopharmaceutical and medical device innovation and technology.”

Abiomed, which “will operate as a standalone business within Johnson & Johnson MedTech,” as Wednesday’s press release explained, is a leading provider of cardiovascular medical technology “with a first-in-kind portfolio for the treatment of coronary artery disease and heart failure, an extensive innovation pipeline of life-saving technologies.”

Noting that the acquisition “is an important step in the execution of our strategic priorities,” Joaquin Duato, CEO of Johnson & Johnson, stressed “the addition of Abiomed provides a strategic platform to advance breakthrough treatments in cardiovascular disease and helps more patients around the world while driving value for our shareholders.”

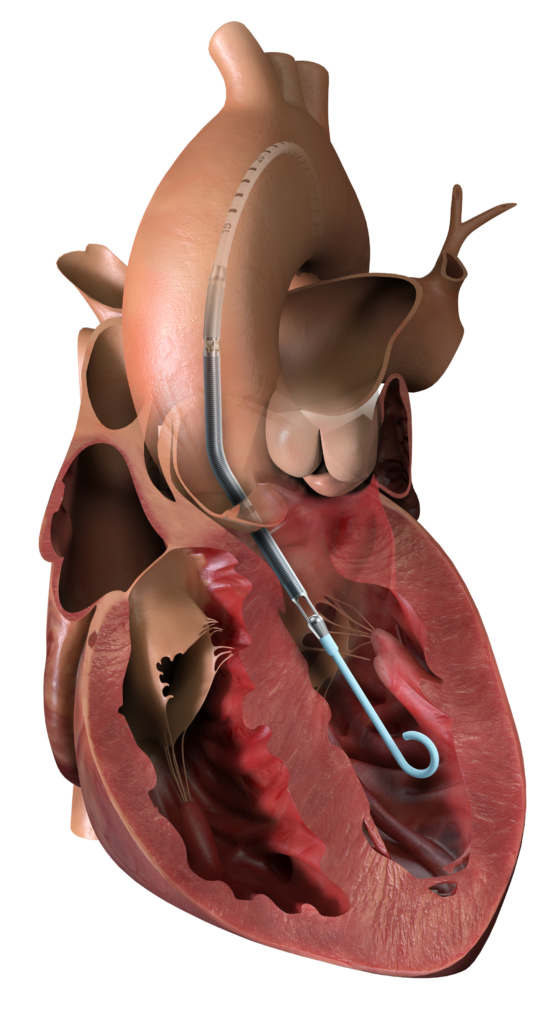

As the company noted, the acquisition “diversifies and expands” the company’s portfolio by adding a leading platform to address heart failure and recovery: Impella® heart pumps. In addition to accelerating “near- and long-term sales and earnings growth,” the companies aim to bring benefits to patients “by advancing the mission to make heart recovery the global standard of care.”

Just one week ago, Abiomed announced a new program aimed at addressing healthcare disparities in underserved communities “as new data provides an example of how better access to Impella heart pumps can improve health equity for non-Caucasian cardiovascular patients.”

“This program is a step toward righting these disparities and improving healthcare in underserved communities by helping all patients receive appropriate care when they are in cardiogenic shock, right heart failure, or in need of a Protected PCI,” said Myron Rolle, MD, global neurosurgery fellow at Massachusetts General Hospital, chair of the Caribbean Neurosurgery Foundation and a member of the Abiomed Board of Directors.

More Reading: New Johnson & Johnson CEO predicts decade of innovation in health care