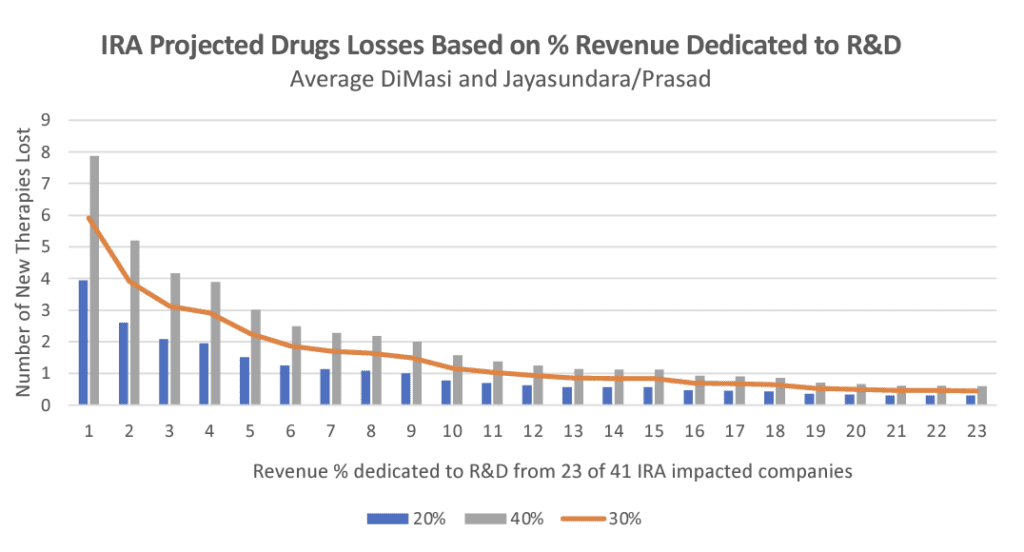

The drug price controls in the Inflation Reduction Act (IRA) will have a far more serious impact on new drug development than previously expected, says a new study. Patients could lose access to at least 40% of the new medicines that would have been developed over the next 10 years.

If the IRA had been in place in 2014, there would be a 40% reduction in revenue on impacted drugs. This means 24-49 of the therapies currently available today would probably not have come to market, and would therefore not be available to patients, says the study by Vital Transformation (VT).

The impact on R&D

The study used previous economic modeling to estimate the impacts of the law’s pricing provisions. The IRA allows the Centers for Medicare and Medicaid Services (CMS) to demand “negotiation” of prices for the drugs on which it spends the most. Drug makers who don’t agree with the price CMS wants to set can be heavily penalized.

Given the reduction in expected revenue, drug makers have already begun to decide against developing some drugs.

“The IRA’s impact grows over time—cumulatively affecting 100 drugs over the next 10 years. The revenue reductions on these drugs are so large that 37 drugs currently available today would likely have not come to market if the IRA policies had been in place over the past decade,” says Vital Transformation CEO Duane Schulthess. “Looking forward, we estimate that, because of the IRA, as many as 139 therapies may not be developed and thus will not get to patients over the next 10 years.”

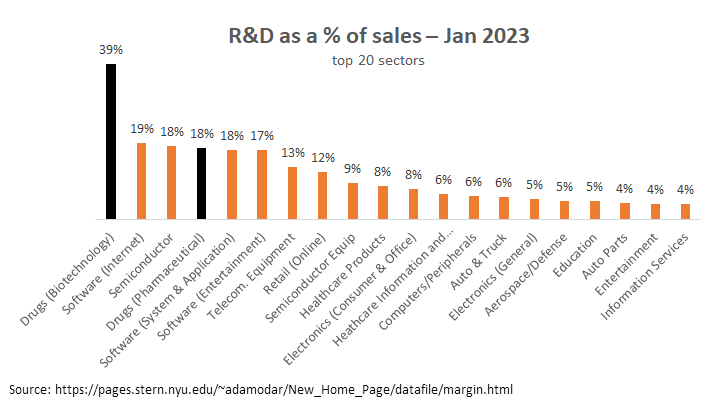

As the VT analysis noted, “The biopharma sector, on average, allocates 50% more of its revenues to R&D than the next closest sector (software and Internet companies).”

The research and development required to bring a new drug to market takes years, and it costs more than $2 billion on average, according to research by Deloitte.

“We are already seeing companies stop critical research because of the IRA. This analysis shows that these impacts will only grow and become more severe—harming patients desperate for treatments for cancer, orphan diseases, and other areas of unmet patient need,” according to Biotechnology Innovation Organization (BIO) Chief Policy Officer John Murphy.

The impact on orphan drugs

Potentially life-saving treatments have been discovered by taking an existing drug and looking at whether its use is indicated for another purpose. The IRA exempts orphan drugs for rare diseases from price negotiations, but only if the drugs are used for a single rare disease.

The unintended consequence of this result is to disincentive orphan drug development for rare cancers and other diseases.

“Our modeling uncovered that a successful cancer drug company will lose a substantial amount of its future earnings as well as pay a large penalty for focusing on orphan indications. In fact, our assessment indicates that delaying market entry by three years to target a stage two adjuvant cancer treatment improves the return on investment by over half-a billion dollars,” says VT consulting economist Dr. Harry P. Bowen.

Read the full study on the Vital Transformation website.

The study was developed with support from BIO.